Bitcoin has experienced a significant decline, dropping from early-November highs around $110,000 to trade close to $96,000. This downturn has brought the cryptocurrency into a fear-zone sentiment, evidenced by nearly $1 billion in outflows from exchange-traded funds (ETFs) and weakened market depth. According to a recent analysis by 10x Research, this situation aligns with their Bear Market Watch predictions, indicating a reset phase driven by liquidity, funding, and flow dynamics.

During this latest fluctuation, Bitcoin reached a 24-hour low of approximately $94,755 before recovering slightly to hover around $96,000. This movement has reignited focus on whether the selling pressure stems from leveraged positions, market flows, or broader macroeconomic concerns. Following a series of weaker closing prices, the market appears to be shifting from momentum trading towards a phase of repair.

The sentiment gauge has dipped into the fear territory, with readings in the low 20s observed this week. This trend indicates a shift towards risk reduction rather than a reaction to a specific headline shock. 10x Research had previously highlighted this transition in their October 22 “Bear Market Watch,” suggesting a potential move toward the $100,000 mark, while also noting the diminishing support from on-chain and derivatives data. This perspective aligns with how the current pullback has unfolded.

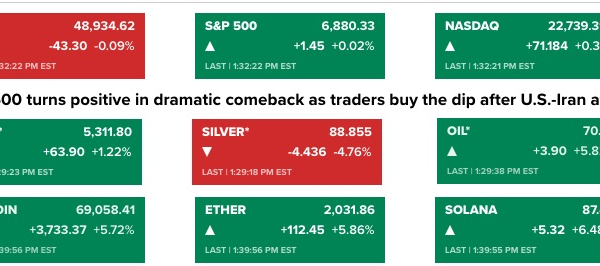

Several macroeconomic factors have influenced this downturn, with hawkish signals coming from the broader market. Fund data indicates that the stress has been particularly concentrated within Bitcoin investment vehicles, with nearly $1.0 billion in net outflows reported in the week leading up to November 3. In contrast, other cryptocurrencies have seen some compensatory interest, largely explaining the greater pressure on Bitcoin spot pairs.

The pricing dynamics across major cryptocurrencies have reflected this sentiment, where Bitcoin led the declines while Ethereum followed suit shortly thereafter. Community discussions across trading forums have centered on the mix of ETF redemptions, tightening basis, and thinner order books during U.S. trading hours. The drop in the fear index suggests a rotation from dip-buying strategies to a more protective stance among investors.

As the market heads into the weekend, the next phase will depend heavily on whether flows stabilize. The volatility landscape for both Bitcoin and Ethereum appears to be relatively clear, with the one-month implied volatility closely matching realized volatility. This situation enables traders to manage their positions without incurring a carry penalty.

For recovery to gain momentum, the market needs to observe improved depth in both Bitcoin and Ethereum trading pairs. Tighter spreads and a more robust inventory from market makers indicate willingness to hold positions through volatile periods. When accompanied by stable funding conditions and a neutral basis, the potential for extended rallies increases as demand for cash replaces short-term squeezes.

Furthermore, trends in stablecoin supply serve as an additional indicator. An increase in net issuance over several sessions typically coincides with stronger spot settlements, while stagnant or declining supply tends to hinder sustainable recoveries, even with intraday price bounces.

10x Research emphasizes a methodology that integrates on-chain flow analysis, derivatives positioning, and macroeconomic context. Their record of accurately predicting year-end market movements in the recent past lends credibility to their current outlook. Monitoring funding conditions, depth recovery, and pressure from realized losses on-chain will be crucial in determining the market”s trajectory.

For Ethereum to regain stability, a consistent closing price is necessary to bring the basis back towards neutral. Additionally, large-cap tokens like Solana and XRP generally strengthen after Bitcoin“s market depth improves, highlighting the importance of closely observing Bitcoin order books, ETF flow directions, and the fear gauge over the upcoming sessions.