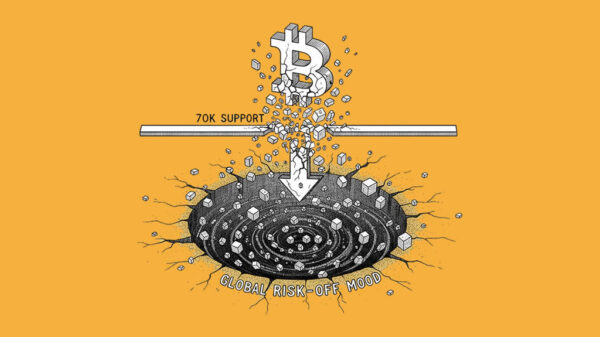

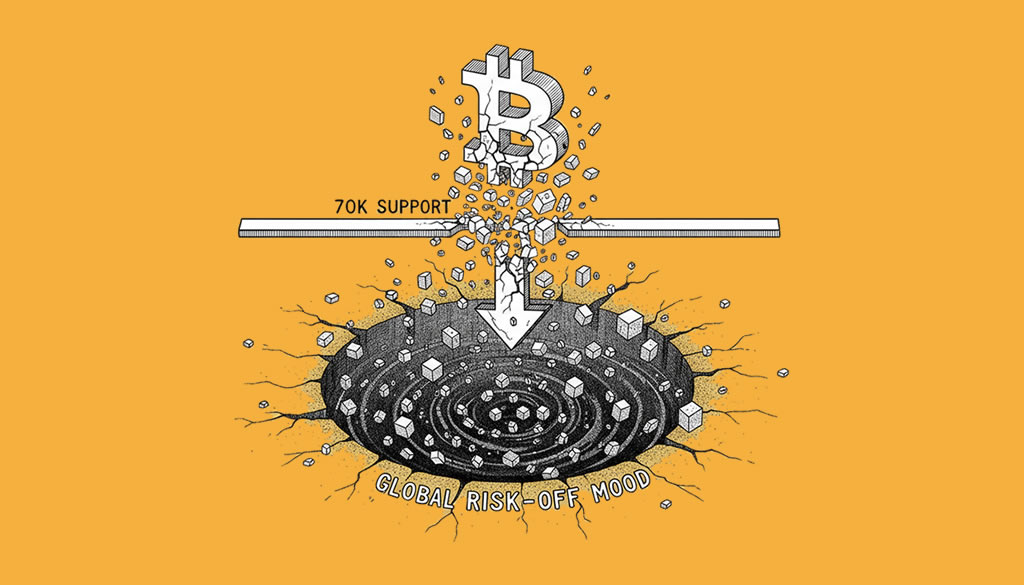

Bitcoin has experienced a significant downturn, dropping below the crucial $70,000 threshold in a swift 7% decline over the past 24 hours. This move comes in the wake of a broader risk-off sentiment gripping global markets, particularly impacting technology stocks.

The leading cryptocurrency hit lows around $69,917 according to CoinDesk and $69,101 on Bitstamp, marking its lowest point since late 2024. This steep decline has erased much of the gains seen after the 2024 bull market, with the Fear and Greed Index plunging to an extreme fear level of 11.

As Bitcoin trades at approximately 20% below the estimated production cost of $87,000, miners are facing increasing pressure. Historically, such conditions have often led to capitulation phases in bear markets, which could result in adjustments to the hashrate despite recent recoveries from previous drawdowns.

The current selloff has also triggered substantial liquidations, wiping out millions in leveraged positions and contributing to continued outflows from U.S. spot Bitcoin ETFs. Analysts are now monitoring the market for potential deeper corrections toward $67,000 or lower, with some suggesting that this reset could be healthy for future recovery amid volatile conditions.

One market observer emphasized, “Bears have taken firm control,” pointing to the breach of the $70,000 support level as a key psychological turning point. This sentiment is further reflected in on-chain metrics, which indicate fading demand, reduced participation, and tightening liquidity across the market.

As the cryptocurrency landscape continues to evolve, the correlations between Bitcoin and traditional risk assets remain apparent, underscoring the need for caution when engaging in leveraged decentralized finance (DeFi) and futures positions.

In summary, the recent drop below $70,000 is a stark reminder of the ongoing volatility that characterizes the cryptocurrency market, highlighting both the risks and the potential for recovery as traders navigate these challenging conditions.