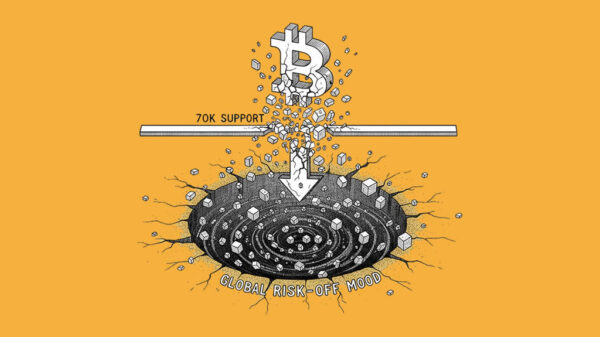

On February 5, Bitcoin experienced a significant downturn, dropping 7% intraday and falling below the $66,000 threshold. This decline saw the cryptocurrency reach a low of $65,253 on Bitstamp, igniting widespread fears of a potential retreat toward the $60,000 mark.

This latest plunge has extended Bitcoin“s weekly losses to over 20%, marking a notable 30% correction from its mid-January peak near $98,000. The rapid decrease in value has intensified sell-offs across the market, creating a wave of panic among investors.

The current market environment is characterized by heightened volatility, as traders react to the sharp price movements and the broader implications for the cryptocurrency landscape. As Bitcoin continues to grapple with these challenges, market participants are left wondering whether the bottom has been reached or if further losses are imminent.

In light of this situation, it is crucial for investors to remain vigilant and informed about market trends and potential recovery signals. Understanding the underlying factors driving Bitcoin“s price fluctuations will be key to navigating this turbulent period.