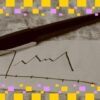

Bitcoin (BTC) has recently dipped below $100,000 and is on the brink of a significant technical event known as a death cross. This phenomenon occurs when the 50-day simple moving average (SMA) crosses beneath the 200-day SMA, a pattern historically associated with market bottoms. However, the broader macroeconomic landscape and trading dynamics for 2025 differ markedly from previous cycles, prompting speculation: could this represent a genuine bottom or merely a phase in a prolonged capitulation?

As the anticipated death cross approaches, analysts have been closely monitoring the situation. The crossing of the 50-day SMA below the 200-day SMA is expected to occur within the next few days, with analyst Colin forecasting this event around mid-November, potentially just 1 to 2 days away. Leading up to this occurrence, Colin predicts that BTC may experience further declines, with altcoins likely to face even steeper losses. This outlook aligns with BTC”s recent drop below the $100,000 mark.

Historical data supports the notion that BTC often finds a bottom around such death cross events, although the timing can vary. An analyst on X highlighted that since 2018, Bitcoin has experienced at least eight death crosses. Each instance typically saw BTC establish a local bottom within 5 to 9 days, followed by rallies of at least 45% from those lows. If the recent decline below $100,000 is indeed a local bottom, projections indicate that BTC could surge to a minimum of $145,000.

Further reinforcing this perspective, Ash Crypto noted that during the last three death crosses, Bitcoin bottomed within a week before embarking on substantial upward movements to new all-time highs. However, a more cautious viewpoint has emerged from other analysts. One user on X pointed out that following a death cross, BTC has historically faced average maximum losses exceeding 30% over the subsequent 12 months. Moreover, past trends indicate that it typically takes BTC around 141 days to reach a peak post-cross.

If the upcoming death cross occurs in mid-November while BTC remains around $100,000, this analysis suggests a potential retracement toward the $70,000 range. Such a scenario may precede a new upward cycle.

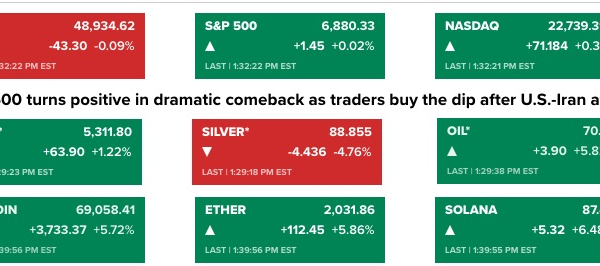

Looking ahead, if the death cross coincides with a final capitulation event, history suggests a quick rebound could follow. Conversely, if macroeconomic conditions deteriorate, the death cross might herald a deeper correction, consistent with the historical average decline of approximately 30% within a year. Notably, a death cross serves primarily as a timing indicator and should not be viewed as an infallible signal of market tops or bottoms. Traders are encouraged to consider additional factors such as trading volume, RSI/MACD divergences, on-chain activity, and stablecoin liquidity to gauge probabilities more accurately.

Currently, the prevailing scenario appears to favor a brief capitulation followed by the formation of the death cross and a subsequent strong rebound. Nonetheless, short-term traders are advised to manage their risk carefully, establishing appropriate stop-loss levels and awaiting confirmation of recovery—such as a daily close above the 50-day SMA accompanied by increasing volume—before making significant allocations.