Bitcoin is currently attracting significant attention as it approaches the pivotal $58,000 support level, projected for 2026. This price point has been highlighted by Kalshi prediction markets as a crucial target for the cryptocurrency”s future performance.

The $58,000 mark coincides with a key long-term technical indicator on the weekly chart: the 300-week exponential moving average (EMA). This moving average is steadily ascending and is presently situated in the mid-$50,000 range, thereby reinforcing the significance of the anticipated $58,000 zone.

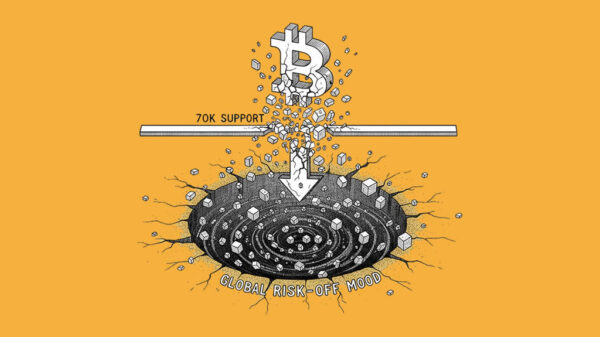

What makes this convergence particularly noteworthy is its alignment with the estimated electrical cost of mining Bitcoin. This creates a three-fold synergy between market expectations, technical support, and production economics. The current trading position of Bitcoin is above its 300-week EMA, yet it has recently retreated from highs in the mid-$60,000 range.

As the moving average continues to trend upward, the distance between the current price and this critical baseline support narrows, amplifying the focus on the $58,000 level. The intersection of prediction markets, long-term moving averages, and mining cost estimates pointing to the same price zone usually serves as a significant focal point for traders.

This convergence suggests a structurally important level that could greatly influence market behavior if Bitcoin tests this area. Traders and market participants will be closely monitoring how the price reacts as it approaches this critical juncture.