The cryptocurrency market is experiencing significant turmoil as Bitcoin approaches a precarious price floor of $56,100, driven by alarming inflation warnings and massive outflows from exchange-traded funds (ETFs). This week marks a pivotal moment in trading psychology, shifting the focus from technical charts to the fundamentals of cash and collateral.

Over the past week, Bitcoin has witnessed a drastic decline of approximately 24%, plummeting from about $90,076 to a low of $66,700. Concurrently, silver has faced even steeper losses, dropping around 34%. Other assets are also feeling the strain, with gold down over 6%, and U.S. equity futures falling about 2%. The dollar index has risen by 2%, while oil prices increased by 1.6%. This combination signals stress in the markets, prompting traders to reduce leverage and raise cash to weather the uncertainty.

The immediate catalyst for silver”s decline stemmed from the Chicago Mercantile Exchange (CME) raising margin requirements for precious metals, compelling traders to inject more cash into their positions amidst extreme volatility. The new margins have escalated from $20,000 to $32,500, creating a ripple effect that has forced many leveraged players to unwind their positions rapidly.

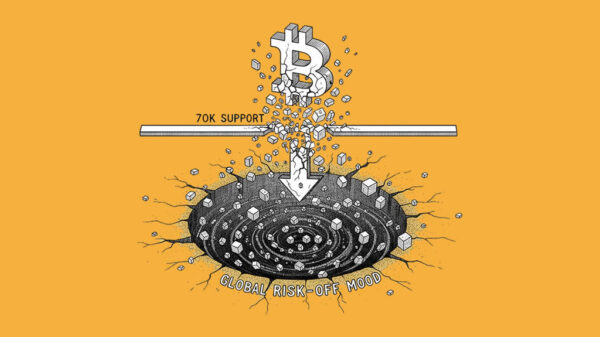

As Bitcoin continues its downward trajectory, it is crucial to note the chart pattern resembles a staircase, with each drop punctuated by brief periods of stability before further declines. The critical support level at $73,600 has been breached, and the next target for bears is the $56,100 threshold, where significant testing occurred in 2024. If Bitcoin fails to hold this level, further declines into the $40,000 range could be on the horizon.

ETF flows have been a significant driver of Bitcoin“s volatility. When inflows are robust, dips tend to be bought quickly; however, recent trends indicate a concerning shift toward heavy outflows. Data from Farside highlights a pattern of negative flows, with net outflows occurring consistently since late January, suggesting hesitance in demand amidst ample supply.

Looking back to last October, the market was buoyed by strong ETF inflows, but the sentiment shifted dramatically by mid-October, signaling deeper issues. The Fed”s stance on inflation remains a point of concern, with rising inflation expectations complicating the economic landscape. Recent analyses suggest that higher inflation risks are being underestimated, primarily due to factors such as tariffs and tight labor markets.

The current market environment resembles a classic risk-off scenario, with Bitcoin correlating more closely to U.S. equity futures than traditional safe-haven assets like gold. As silver and Bitcoin both experience significant drops, it reflects a broader trend of forced selling driven by leverage.

Oil prices have also increased, but the reasons behind this rise stem from geopolitical risks rather than genuine demand, adding another layer of complexity to the inflation narrative. Traders are on edge as global margin calls appear to escalate, creating a challenging environment as the recovery trade falters under the weight of inflation concerns.

Moving forward, it is crucial for Bitcoin to reclaim the $73,600 mark to avert further declines. The current market dynamics highlight a fragile state, with ETF flows needing to stabilize to mitigate the selling pressure. The macroeconomic landscape also needs to calm, particularly regarding inflation expectations and geopolitical risks, for the market to regain confidence.