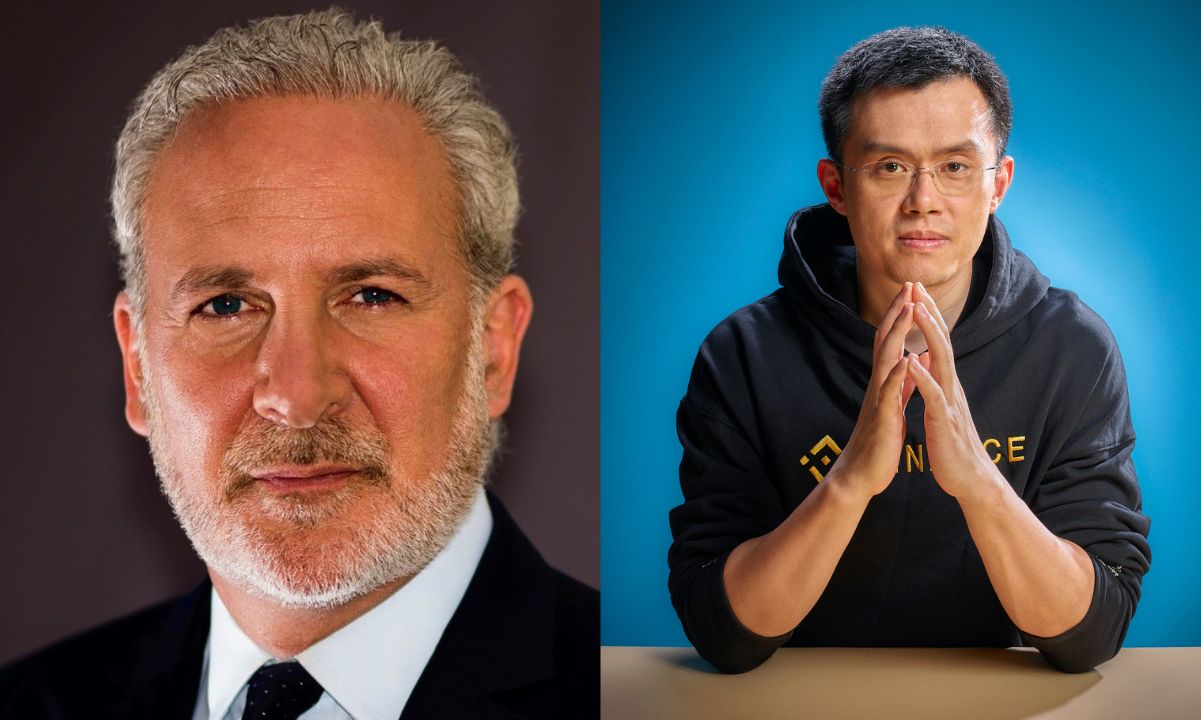

On December 4, a significant debate unfolded at the Binance Blockchain Week 2025 in Dubai, featuring Changpeng Zhao (CZ), CEO of Binance, and veteran investor Peter Schiff. This event reignited discussions surrounding the long-standing rivalry between Bitcoin and gold as viable stores of value in today”s financial landscape.

The debate captivated a lively audience both in-person and online, with Binance”s official account describing the exchange as “intense and intellectual.” CZ quickly asserted that over time, Bitcoin outperforms gold, stating, “I think gold would do well, but Bitcoin will do better.” He emphasized Bitcoin”s defined supply and transparency, contrasting it with gold reserves, which he noted can be uncertain. “We know exactly how much there is and where it all is,” he added.

Schiff, a well-known critic of Bitcoin, countered with a series of arguments. He maintained that Bitcoin lacks intrinsic value, asserting it is “backed by nothing” and has no practical industrial use. According to Schiff, Bitcoin cannot genuinely serve as money because “nothing is priced in Bitcoin,” and he criticized the prevailing activity around it as mainly speculative trading rather than substantive economic transactions.

Highlighting a memorable moment, CZ produced a 1kg gold bar from Kyrgyzstan, inviting Schiff to verify its authenticity. Schiff”s inability to do so without lab testing allowed CZ to underline Bitcoin”s straightforward verification process. The discussion shifted to the practicality of payments, where Schiff contended that crypto cards merely convert Bitcoin to fiat currency. CZ rebutted this, arguing that users prioritize speed and convenience, asserting, “people already use crypto for payments, conversions happen in the background.”

This debate not only showcased their opposing views but also reflected a broader conversation about the relevance of digital currencies in comparison to traditional assets. Schiff firmly defended gold”s physical properties, historical longevity, and its appeal to central banks. He cautioned that Bitcoin”s volatility signifies speculative behavior rather than genuine economic utility. Conversely, CZ portrayed Bitcoin as an essential financial tool for a digital future, highlighting its borderless nature, programmability, and predictable supply.

While no official verdict was declared at the event, sentiment on social media leaned toward CZ, with many observers suggesting that Schiff”s arguments seemed outdated, whereas CZ”s perspective aligned with a future-oriented vision shaped by increasing global adoption of cryptocurrencies.