Bitcoin (BTC) has plunged dramatically, falling over 10.8% in the past 24 hours to reach $81. The cryptocurrency is experiencing one of its worst weeks of the year, with this November marking its second-worst performance in history. Analysts, including one known as CryptoDan, suggest that this downturn may merely represent a phase in a larger bullish cycle, describing it as a “natural phenomenon seen in long-term cycles.”

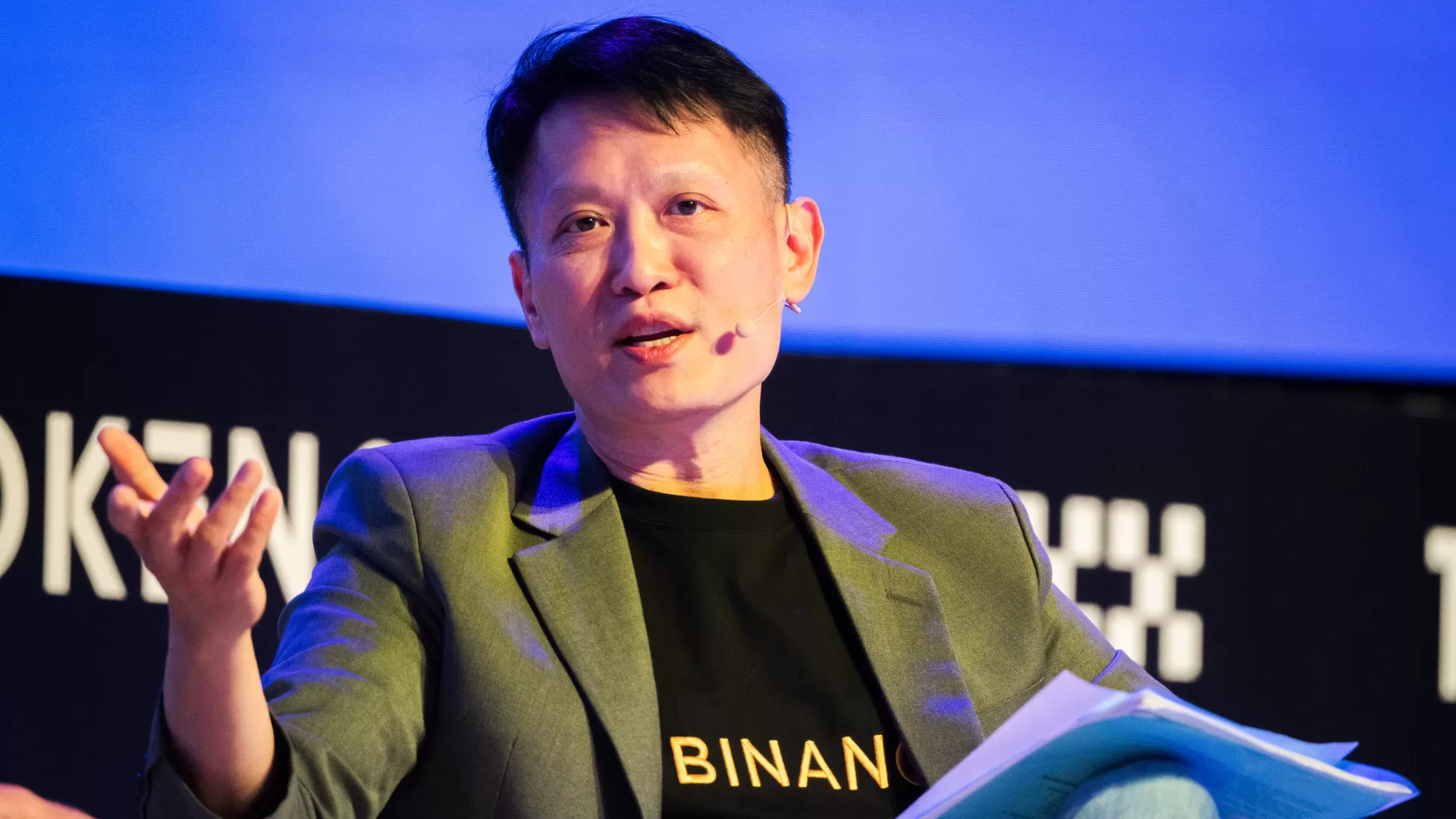

While some market participants interpret Bitcoin“s decline as a sign of a bear market, others regard it as a necessary corrective phase. Richard Teng, the CEO of Binance, has characterized this recent price drop as a healthy correction, drawing parallels with traditional financial markets. He pointed out that the volatility currently observed in Bitcoin is largely a reflection of a broader trend of risk aversion seen across various asset classes.

Teng elaborated on the situation, indicating that the ongoing decline is part of a natural process involving deleveraging and profit-taking. He reassured investors that this phenomenon is not unique to digital currencies, noting that such volatility is consistent with most major asset categories. Despite the recent downturn, Bitcoin”s value still remains more than double what it was at the start of 2024. “The crypto industry has performed very well over the last year and a half, so it is not unexpected that people are taking profits,” Teng stated.

In closing, Teng emphasized that the current correction provides an opportunity for the market to consolidate and build a more robust foundation for future growth. He expressed confidence that any form of consolidation is beneficial, allowing the crypto sector to stabilize and prepare for the next phase of its evolution.