In a recent analysis, crypto analyst Benjamin Cowen discusses the current state of the cryptocurrency market, highlighting that the dynamics favor tactical rallies over sustained growth. His insights, presented in the latest edition of the Crypto Macro Risk Memo—Q1 2026, indicate that Bitcoin and the broader crypto landscape have transitioned past their primary growth phase.

Cowen elaborates that with ongoing tight liquidity conditions, price movements are expected to be short-lived and selective, rather than the onset of a new, enduring bull market. He believes that Bitcoin has likely completed its cycle from 2023 to 2025 and is now in a digestion phase reminiscent of mid-2019. The peak for Bitcoin occurred in the last quarter of the previous year, a pattern consistent with post-halving cycles.

However, the nature of this peak diverges from those observed in 2017 and 2021. Historically, peaks were characterized by heightened excitement, rapid retail investments, and widespread speculation. In contrast, the latest peak was marked by a general sense of apathy, with diminished social engagement and speculative activity, even as Bitcoin achieved new highs.

Cowen asserts that peaks driven by apathy are likely to result in more volatile declines rather than severe downturns, potentially extending bear market phases. He notes that the downturn in 2019 was shorter than the prolonged declines that followed the euphoric peaks of the previous cycles in 2017 and 2021. Nevertheless, price movements during these periods were inconsistent and often accompanied by numerous countertrend rallies that did not significantly alter the overarching trend.

Adding another layer of complexity, Cowen points out that macroeconomic conditions are presenting additional challenges. While economic growth shows signs of slowing, it remains sufficiently robust to limit aggressive liquidity support. Historically, Bitcoin has peaked before monetary policy stabilizes. In previous cycles, prices continued to decline even after tightening measures were slowed or ceased.

As a result, Cowen emphasizes a shift in risk management, leaning towards capital protection rather than pursuing aggressive growth strategies. He also references cycle-relative data, noting that early-year calendar returns can create a misleading impression of strength. Once Bitcoin enters a post-peak phase, returns tend to diminish over time, with long-term holders often selling into rallies, which creates overhead supply. Without a consistent influx of new demand, the potential for upside becomes constrained while downside risks remain prevalent.

In a significant portion of his memo, Cowen details how current market dynamics align with a post-cycle environment. The performance of crypto markets is influenced not only by the available liquidity but also by the willingness of that liquidity to take on risk. Although the balance sheet of the Federal Reserve has begun to grow again, Cowen argues that this expansion is primarily related to reserve management and support for the financial system, lacking the kind of stimulus that typically encourages speculative risk-taking.

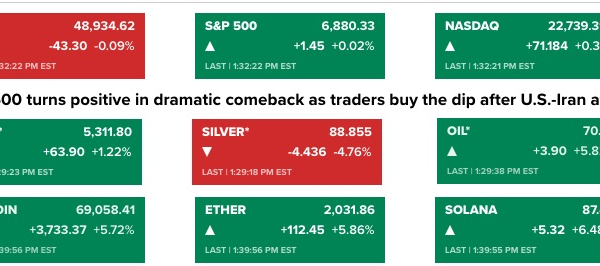

In previous robust crypto bull markets, Bitcoin has closely mirrored other risk assets, benefiting from free-flowing capital across various markets. Currently, correlations indicate a divergence, with equities and metals remaining tied to macro-driven capital while crypto markets exhibit less consistency. This suggests that the liquidity supporting traditional stocks and real assets is not being funneled into digital assets at comparable levels.

Considering these factors, Cowen concludes that the crypto market appears to be in a digestion phase akin to that of 2019. While short-term rallies are anticipated and certain assets may perform well temporarily, structural constraints will persist until liquidity conditions, participant levels, and on-chain indicators undergo a reset. For the time being, the crypto landscape seems more suited for tactical positioning rather than broad, long-term expansion.