Ethereum co-founder Vitalik Buterin has expressed serious concerns regarding the current trajectory of prediction markets. In a recent post on X, Buterin emphasized the need for these platforms to evolve from a focus on short-term speculation to a model that emphasizes long-term financial utility.

Buterin acknowledged the significant growth of prediction markets, noting that trading volumes have reached levels sufficient to support professional participants. He pointed out that these platforms often serve to enhance traditional media by aggregating forward-looking information. However, he cautioned that much of the activity is increasingly focused on short-duration bets related to cryptocurrency prices and sports wagering, which he believes offer only fleeting engagement and limited informational or societal value.

He identified a structural issue within prediction markets: the reliance on a steady stream of losing participants to ensure profits for informed traders. He categorized participants into three groups: inexperienced speculators, institutional information buyers, and hedgers. Buterin argued that the prevailing model disproportionately depends on uninformed traders, a practice he believes can distort incentives, leading to engagement strategies that prioritize trading volume over substantive interaction.

In his analysis, Buterin also highlighted the challenges faced by information-buying models where organizations subsidize markets to extract insights. Once such information becomes public through market pricing, it is accessible to all, thus diminishing the incentive for any single entity to support it on a large scale.

To address these concerns, Buterin proposed that prediction markets expand into generalized hedging tools. In this model, participants would accept slightly negative expected returns in exchange for mitigating exposure to external risks. For instance, an investor in biotech could utilize an election-based prediction market to hedge against political outcomes that may adversely affect their holdings. This approach could enhance overall risk-adjusted stability rather than merely pursuing speculative profits.

Buterin further suggested that prediction markets could eventually evolve into personalized economic stabilizers. Instead of relying on fiat-backed stablecoins, individuals might hold customized baskets of market positions tied to price indices that reflect their future spending requirements. This system could allow users to combine growth assets, such as ETH or tokenized equities, with specially designed prediction positions that stabilize their purchasing power, potentially decreasing dependence on traditional currency frameworks.

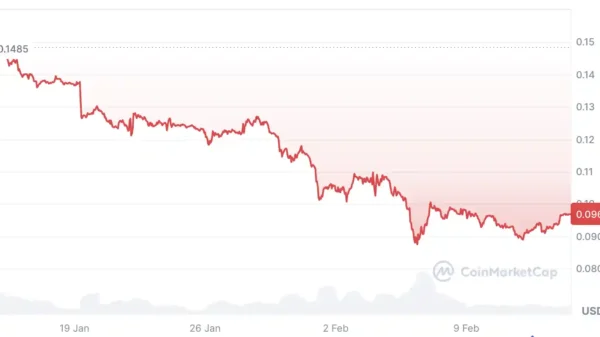

He concluded by urging platforms to prioritize the establishment of robust financial infrastructure over transient engagement models. According to a report by CertiK, prediction markets have experienced a four-fold increase in activity over the past year. This transition from niche products to widely utilized financial tools has been marked by a year characterized by rapid trading growth, increasing technical vulnerabilities, and varied regulatory responses across key jurisdictions.

CertiK”s study indicates that annual trading volumes in the prediction market sector have multiplied significantly, with liquidity heavily concentrated among a few leading platforms, including Kalshi, Polymarket, and Opinion. Despite the impressive growth, the report highlights the structural weaknesses that have emerged alongside this expansion. A notable incident occurred in late 2025 when a third-party authentication service integrated by Polymarket was compromised, raising concerns about the vulnerabilities introduced by hybrid Web2-Web3 models.

CertiK anticipates ongoing institutional interest, clearer regulatory frameworks in some regions, and technical improvements designed to bolster privacy and resilience. The firm envisions prediction markets not merely as speculative tools but as essential infrastructure for managing real-world uncertainty.