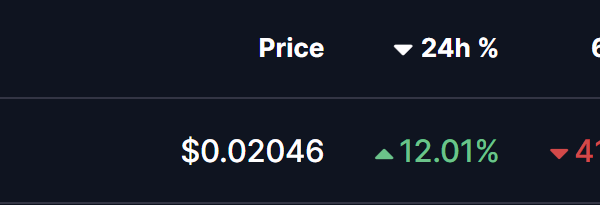

The current state of the cryptocurrency market has been marked by a notable absence of bullish sentiment following the crash on October 10. Bitcoin (BTC) has notably diverged from gold, experiencing a decline while the precious metal has surged. As gold and silver reached highs above $5,000 and $110 respectively, Bitcoin fell to $86,000, with concerns it may revisit its recent low of $80,600 if the trend continues. Ethereum (ETH) has similarly been confined within a range of $2,800 to $3,200 since November, recently testing the lower end of its range after Bitcoin”s downturn.

In light of the subdued price movements in the crypto space, Tom Lee, founder and head of research at Fundstrat, commented on the factors influencing this trend. He attributed the lack of momentum in cryptocurrencies to the recent liquidation events and the rally in precious metals. Lee stated, “The precious metals” move has sucked a lot of oxygen out of the room. So crypto prices aren”t keeping up with fundamentals. But when fundamentals go to the right, prices do follow.” He emphasized that as long as gold and silver are on the rise, investors might favor these metals over Bitcoin. However, he anticipates that a pause in the rally of gold and silver could pave the way for a resurgence in Bitcoin and Ethereum prices.

In a strategic move, Bitmine, of which Lee is the chairman, has staked over half of its substantial holdings exceeding 4 million ETH. Recently, the firm acquired an additional 20,000 ETH and staked a remarkable $610 million in ETH, totaling over 2.2 million ETH worth approximately $6.5 billion. This represents 52% of its overall holdings.

Interestingly, the demand for ETH staking has reached unprecedented levels, crossing 30% of the total ETH supply, coinciding with multiple U.S. spot ETH ETFs seeking yield on their assets. Furthermore, the average transaction costs on the Ethereum network have decreased significantly, offering a more competitive environment for users.

Despite the ongoing challenges in ETH”s price trajectory, Lee believes that it will ultimately align with the strong fundamentals underpinning the network. He pointed to critical liquidity levels at $2,980 and $2,850 for Ethereum, which are essential for both leveraged shorts and longs ahead of the Federal Reserve”s rate decision. Historically, volatility driven by liquidity captures tends to direct price movements toward these pivotal levels.

As the market observes these dynamics, many are left wondering how long the current range-bound state will persist and if a significant price shift is on the horizon.