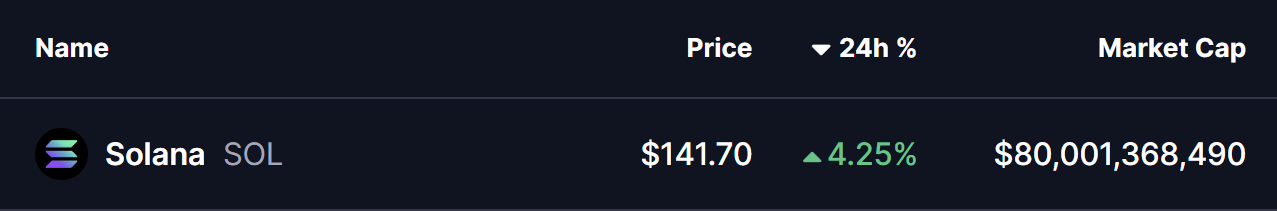

Solana (SOL) is on the cusp of a crucial breakout, as it experiences a 4% increase in value, buoyed by positive developments in the cryptocurrency market. The broader market is enjoying a firm uptrend, with Bitcoin hovering around the $92,000 threshold and Ethereum gaining nearly 2% at the time of this report. This overall market strength has provided a supportive environment for select altcoins, including Solana, which is benefiting from improved market sentiment.

A pivotal factor contributing to Solana”s recent performance is its expanding integration with X (formerly Twitter), which recently introduced Smart Cashtags for Solana tokens. This feature allows users to share token symbols in posts, access real-time charts, and retrieve relevant market data directly within the app. This integration has heightened visibility and engagement for Solana within the crypto community, reinforcing its position in the digital asset space.

From a technical perspective, the daily chart for Solana reveals a right-angled descending broadening formation—a pattern often signaling bullish reversals following extended phases of consolidation. In recent weeks, price movements have been constrained beneath the resistance zone of $142.70 to $146.91, with several attempts to breach this area facing rejection. However, a recent rebound from the lower trendline has allowed SOL to regain its 50-day moving average at approximately $132.06, a level that previously served as a significant barrier.

As the price accelerates back toward the critical resistance zone, SOL is now positioned at a crucial juncture where both bulls and bears are being tested. A decisive close above the $146.91 mark would validate the breakout from the descending broadening formation and confirm a broader bullish reversal structure. Such a move is likely to attract additional momentum-driven participation from traders, signaling a shift in market dynamics.

Should the breakout materialize, analysts suggest that Solana could see price targets reaching the $176.97 region, representing a potential upside of approximately 24% from current levels. However, caution is advised until confirmation is achieved, as short-term pullbacks, including potential retests of the 50-day moving average, could occur without undermining the bullish outlook as long as higher lows continue to form.

In summary, Solana is navigating a critical technical and narrative-driven inflection point, driven by a combination of positive market conditions, social media integration through X, and a bullish reversal pattern on its daily chart. The next steps for SOL hinge on its ability to secure a sustained close above the $146.91 resistance zone, which will determine whether the token enters a sustained bullish phase or remains range-bound in the near term.