The New York City Token (NYC), a meme coin launched by former New York City mayor Eric Adams, has experienced a dramatic downturn. After reaching a high market capitalization of $580 million, the token”s value has fallen to less than $130 million in a matter of days.

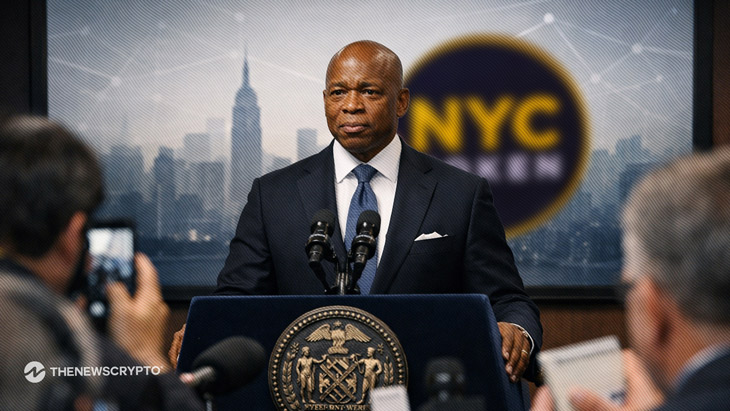

Adams announced the NYC token on January 13 through a post on X, expressing pride in its potential to combat the rise of hate and promote a new wave of revolution within the city. The token, which operates on the Solana blockchain, is designed to address growing antisemitism and anti-American sentiments both in New York and across the nation. The launch was supported by a video of Adams in a taxi, where he emphasized the project”s ambitious goals.

According to data from DEXScreener, the NYC token peaked at a price of $0.58 before its rapid decline. This swift loss in value prompted some community members to question the integrity of the project, alleging that the development team may have intentionally drained liquidity from the market. Analyst Rune reported that approximately $3.4 million was withdrawn from the token”s liquidity pool during this period. Additionally, Bubblemaps indicated that a wallet linked to the token”s deployer removed $2.5 million in USDC liquidity when the token was at its highest valuation.

While these claims have not been officially verified, the official X account for the NYC token stated that the team is implementing a Time-Weighted Average Price (TWAP) mechanism to help stabilize the token”s price. The post assured users that funds are being gradually added to the liquidity pool to mitigate any market disruptions stemming from the initial volatility following the launch.

The NYC token”s rise and subsequent fall highlights the volatile nature of meme coins and the challenges they face in maintaining value, especially when tied to high-profile endorsements. Investors and community members will be closely monitoring the project for any further developments.