A recent report from the Bank of Italy raises alarms about the potential fallout from a significant decline in Ethereum (ETH) prices, which could threaten the stability of over $800 billion in assets. Authored by Claudia Biancotti from the central bank”s Directorate General for Information Technology, the paper outlines a scenario in which a drastic drop in ETH value could undermine the blockchain”s ability to process transactions, effectively freezing a vast array of tokenized financial instruments.

The research challenges the prevailing belief that regulated assets on public blockchains are safe from the inherent volatility of the underlying cryptocurrency. It argues that the reliability of the settlement layer in permissionless networks like Ethereum is closely linked to the market value of its native token. If ETH”s price collapses, the economic incentives for validators—those who confirm transactions on the network—could diminish sharply, leading to a potential breakdown of the entire system.

Understanding the Validator Economics Trap

The core of Biancotti”s argument lies in the contrasting structures of traditional financial markets and decentralized blockchain systems. Traditional settlement systems are overseen by regulated entities that have established capital requirements and backstops from central banks. In contrast, Ethereum relies on a decentralized network of independent validators who are driven by profit rather than regulatory obligations.

Validators face real-world expenses related to hardware, internet connectivity, and cybersecurity, while their income is primarily denominated in ETH. A sustained drop in ETH”s dollar price could render their earnings insufficient to cover operational costs, potentially driving them out of the network. The paper warns of a potential “downward price spiral” where validators, fearing further losses, may rush to sell their staked ETH. This could lead to a scenario where the network loses its validators, causing it to cease functioning altogether.

Impact on Real-World Assets and Network Security

The implications of such a collapse extend beyond mere transaction delays. A significant price drop would lower the economic security budget of Ethereum, making it easier for malicious actors to launch attacks on the network. The economic security budget refers to the minimum investment needed to exert control over the network”s validation process. As the value of ETH plummets, the cost of a successful attack decreases, while the incentive to conduct such attacks may increase due to the valuable assets housed within the network.

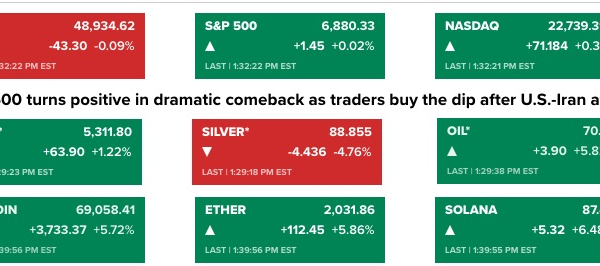

Currently, Ethereum supports an ecosystem that includes over 1.7 million assets valued at more than $800 billion, which consist of tokenized stocks, bonds, and stablecoins. If attackers were to gain control of the network, they could double-spend these assets, effectively transferring value from the crypto world into traditional finance, potentially causing systemic risks.

Challenges in Crisis Management

In traditional financial crises, investors typically seek safer venues for their capital. However, the decentralized nature of Ethereum complicates this process. Attempting to transfer assets to another blockchain during a crisis could be hindered by the vulnerability of cross-chain bridges, which are often susceptible to attacks. Additionally, a significant portion of assets may be locked in decentralized finance (DeFi) protocols that lack the agility to respond quickly to network failures.

The absence of a “lender of last resort” further exacerbates the issue, as Ethereum”s mechanisms to control validator exits are technical rather than economic safeguards. Biancotti”s report emphasizes that without regulatory measures to ensure continuity, the financial system could face severe consequences from a collapse in the value of a speculative cryptocurrency like ETH.

Ultimately, the paper presents a pressing question for policymakers: Should permissionless blockchains be regarded as critical financial infrastructure? The findings suggest that while the allure of public blockchains persists, they carry unique risks tied directly to the speculative nature of their native tokens.