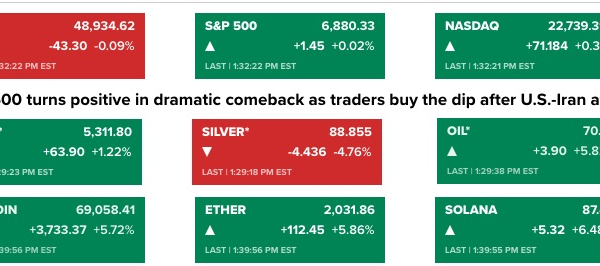

The cryptocurrency market is experiencing a surge of enthusiasm as it approaches the end of Q1 2026, marked by increased activity from both retail and institutional investors. While Bitcoin continues to set the macro narrative, attention is shifting toward Ethereum and lower-cost altcoins that promise significant upside.

Currently, Ethereum is trading around $3,100, boasting a market capitalization of approximately $400 billion. As the leading platform for decentralized finance (DeFi), non-fungible tokens (NFTs), and token issuance, Ethereum remains a cornerstone of the crypto ecosystem. However, its growth potential appears more subdued compared to previous cycles. Analysts have identified critical resistance levels at $3,600 and $3,900, where price rallies have faltered in recent months. Absent a substantial catalyst, such as a new upgrade or a sharp increase in demand, Ethereum may face tighter trading ranges.

In light of this, investors are increasingly exploring lower-priced cryptocurrencies that could offer more substantial growth opportunities. High market capitalizations can hinder scalability, making smaller assets more appealing during bullish market conditions as they typically sit earlier in their price trajectories.

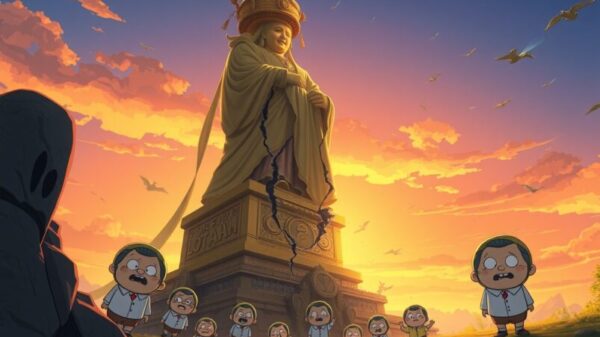

Mutuum Finance (MUTM) has emerged as a noteworthy contender in this environment. The project is focused on creating a decentralized lending protocol that will enable users to lend and borrow assets through smart contracts. The lending model encompasses two distinct environments: a peer-to-contract (P2C) market and a peer-to-peer (P2P) market.

In the P2C market, depositors contribute assets into a collective pool, receiving mtTokens that mirror their deposits and accrued yield. For instance, if a user deposits $2,000 in ETH at a 4 percent annual percentage yield (APY), their mtTokens will reflect the growing balance as borrowers pay interest to access liquidity. This structure allows for passive income generation without the need for users to manage individual loans.

The P2P market caters to assets requiring isolated borrowing setups. Here, borrowers post collateral and incur interest to unlock liquidity, with each loan adhering to specific Loan to Value (LTV) ratios. For example, a user posting $1,000 in collateral with a 70 percent LTV can borrow up to $700. Liquidators play a crucial role by intervening when collateral values dip below safety thresholds, ensuring the protocol remains solvent during market volatility.

Currently in its presale phase, MUTM is priced at $0.04 in Phase 7, employing a structured pricing model that mitigates price spikes and offers transparent access to early users. To date, over $19.8 million has been raised, with more than 18,800 holders securing their positions and approximately 825 million tokens already acquired. The structured nature of the sale, alongside the significant participation rate, suggests a trend of steady accumulation rather than speculative hype.

Security is a priority for Mutuum Finance, with the V1 protocol”s lending code having undergone an audit by Halborn Security, a reputable entity in the DeFi space. Additionally, the MUTM token received a score of 90 out of 100 from CertiK”s token scan, underscoring its robustness. As per updates from the official X account, the protocol is gearing up for deployment on the Sepolia testnet ahead of its mainnet launch. Analysts anticipate that stablecoins will play a vital role in this ecosystem, allowing users to borrow in stable assets to mitigate repayment volatility.

As interest in the MUTM token grows, Phase 7 is witnessing faster sellouts compared to earlier stages, with larger wallet entries emerging, indicating tightening allocations as the distribution phase nears its conclusion. Moreover, for users preferring not to use crypto wallets, card payment options are available, broadening the potential participant base.

Analysts are now placing MUTM on their watchlists for early 2026 positioning, noting that while Ethereum may trend toward $3,500, its relative upside is constrained compared to lower-priced alternatives. With MUTM priced under $0.05 and significant milestones ahead, it stands as a potential frontrunner for investors seeking asymmetric upside in the next crypto market cycle.

For further insights into Mutuum Finance (MUTM), visit their official website here or their Linktree here.