The cryptocurrency market is witnessing a significant surge in exchange-traded funds (ETFs), particularly with XRP and Solana (SOL) leading the charge. Recent reports indicate that XRP ETFs have amassed an impressive $874 million in cumulative net inflows, while SOL ETFs, which debuted earlier, have attracted approximately $682 million. This dynamic showcases the growing interest in altcoin investment options among traders and investors alike.

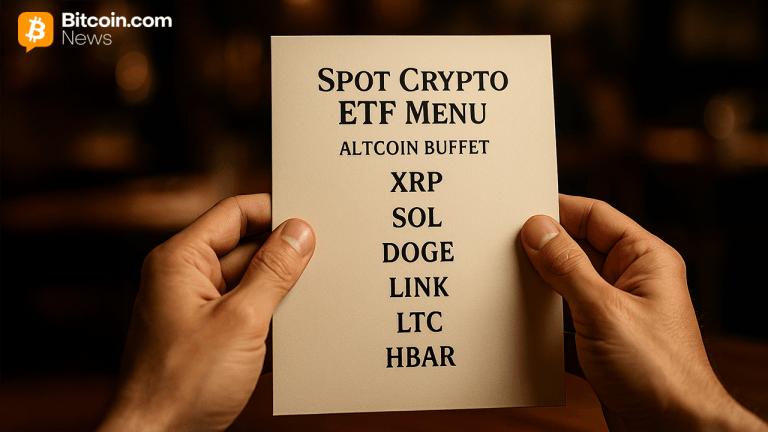

Notably, the influx of capital into these altcoin ETFs reflects a broader trend within the cryptocurrency space as investors seek diversification beyond traditional assets like Bitcoin and Ethereum. The launch of new ETFs linked to other altcoins, including Litecoin (LTC), Hedera (HBAR), Dogecoin (DOGE), and Chainlink (LINK), is further expanding the menu of investment choices available.

As these ETFs gain traction, they not only provide a vehicle for exposure to individual cryptocurrencies but also signify a maturation of the market, where regulatory clarity and institutional interest are paving the way for broader acceptance. Investors are keenly watching how these funds perform as they integrate into diverse portfolios, potentially enhancing liquidity and trading volume across various platforms.

The rapid growth of XRP ETFs indicates a strong market sentiment, particularly as the legal landscape surrounding XRP continues to evolve. This ongoing situation has made XRP a focal point for many investors, who are betting on a favorable outcome that could significantly influence its price and adoption.

In summary, this surge in ETF inflows not only highlights the rising popularity of XRP and SOL but also underscores the increasing appetite for diverse altcoin investments. As the market continues to expand, the introduction of additional altcoin ETFs is likely to attract more participants, thereby enhancing the overall ecosystem of cryptocurrency trading.