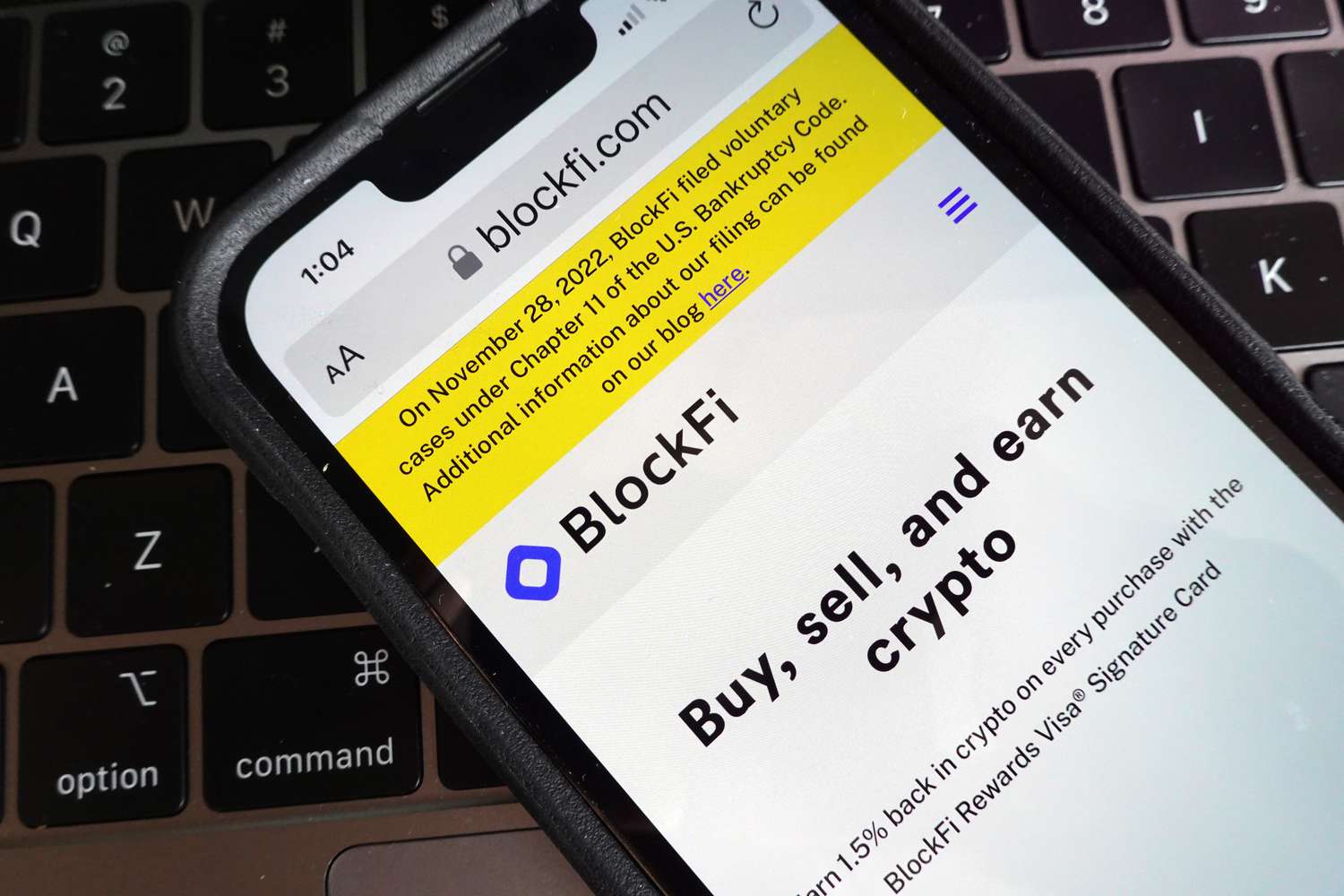

BlockFi’s Decision to Prioritize Investor Repayment

Bankrupt crypto lender BlockFi has made a strategic decision to focus on repaying investors over a $30 million penalty imposed by the U.S. Securities and Exchange Commission (SEC). This move comes after the SEC agreed to defer the penalty payment until investor funds are returned, as revealed in court filings.

Key Points to Note:

- BlockFi will defer the $30 million penalty to prioritize repaying creditors.

- The initial penalty amount agreed upon in February 2022 was $50 million.

- BlockFi is aiming to enable customer withdrawals later this summer.

- The lender holds $1 billion in claims against failed crypto exchange FTX and Alameda Research.

BlockFi Penalty Payment Reprioritized for Investors

The U.S. SEC has agreed to postpone the $30 million fine owed by BlockFi until investors have been fully repaid. This agreement stems from a settlement made in February 2022, where BlockFi had committed to paying a $50 million penalty for not registering its crypto lending product with the SEC. However, following the bankruptcy filing by BlockFi after the collapse of FTX, the situation took a different turn.

The SEC, recognizing the importance of ensuring maximum payments to investors without further delays, has opted to treat its claims as “general unsecured claims” in BlockFi’s Chapter 11 bankruptcy process.

What Lies Ahead for BlockFi Investors?

Typically, during a corporate bankruptcy, investors are often the last to receive payments among various creditors. The agreement between BlockFi and the SEC could potentially benefit investors who have utilized BlockFi’s services, although it might not be sufficient to cover all obligations towards investors.

BlockFi is gearing up to resume customer withdrawals in the upcoming summer, as per reports from Blockworks. Withdrawals had been halted following the FTX collapse.

In a recent ruling, a judge authorized the return of around $300 million from custodial accounts to customers. However, the $375 million held in interest-bearing accounts will not be refunded.

With BlockFi having significant exposure of approximately $1 billion to FTX and Alameda, the potential recovery of some of these funds could present another avenue for the company to fulfill its commitments to customers and creditors.